Investment Scrutiny

Investments Scrutiny using LedgerVision Software

Investment Scrutiny involves checking Investment related ledgers in Tally. Investments includes Fixed Deposits, RD Accounts, Shares, Debentures, Mutual Funds, Liquid Funds etc. Income gets generated on your investments in the form of Interest or Dividends. The Income frequency varies from monthly/ quarterly/ half yearly or yearly basis. In some cases, accumulated returns are also applicable.

Investment Related Configurations

Some basic configurations are required for Investment’s scrutiny as follows:

1. Category Configuration

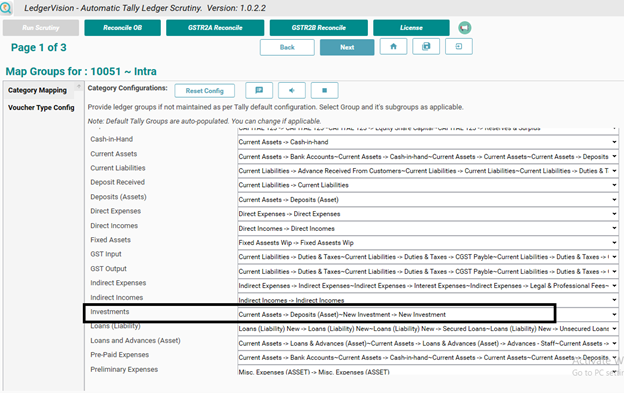

In LedgerVision à Category Configuration page, user must map Tally Groups containing Investment Ledgers in front of Investment Category.

Note: LedgerVision automatically maps default tally Investment groups. But if user has created new group or user has changes the name of the default group then mapping has to be done manually.

Screenshot below how category configuration is done in LedgerVision

2. Investment Ledger Configuration

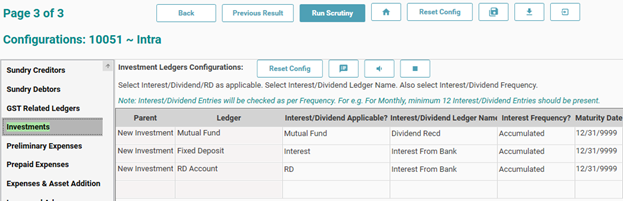

After Category Configuration is done, all the investment ledgers will appear on Investment page on 3rd configuration page as shown in following figure

Configurations required are as follows:

- Select if Interest or Dividend is Applicable

- Select Indirect ledger for Interest/Dividend Ledger

- Select Frequency of the income receipt

- Select maturity date if known

If maturity date is not known, then software automatically takes 31/12/9999 as default date

Note: LedgerVision automatically configures for ease of use

How LedgerVision Performs Scrutiny of Investments

Following rules are checked for all Investment Ledgers:

- There should be income entry and receipt/receivable entry of equal amount. Hence LedgerVision compares Opening and Closing Balances of Investment Ledgers and reports error if any difference is found

- LedgerVision checks payment entries of investment ledgers as per frequency set. For e.g. in case of RD account there should be minimum 12 entries on per month basis

- If investment is maturing in current period, then LedgerVision checks whether maturity proceeds are credited in investment ledger. It also checks that there is no income entry found after maturity date

Your post offers valuable insights into financial knowledge and demonstrates a profound understanding of the subject matter. It is highly recommended for individuals seeking expertise in finance and those looking to deepen their understanding of the field.

Thank you for your feedback