Version V44

1.Added separate GSTR-9C report and bifurcation in GST Results Excel

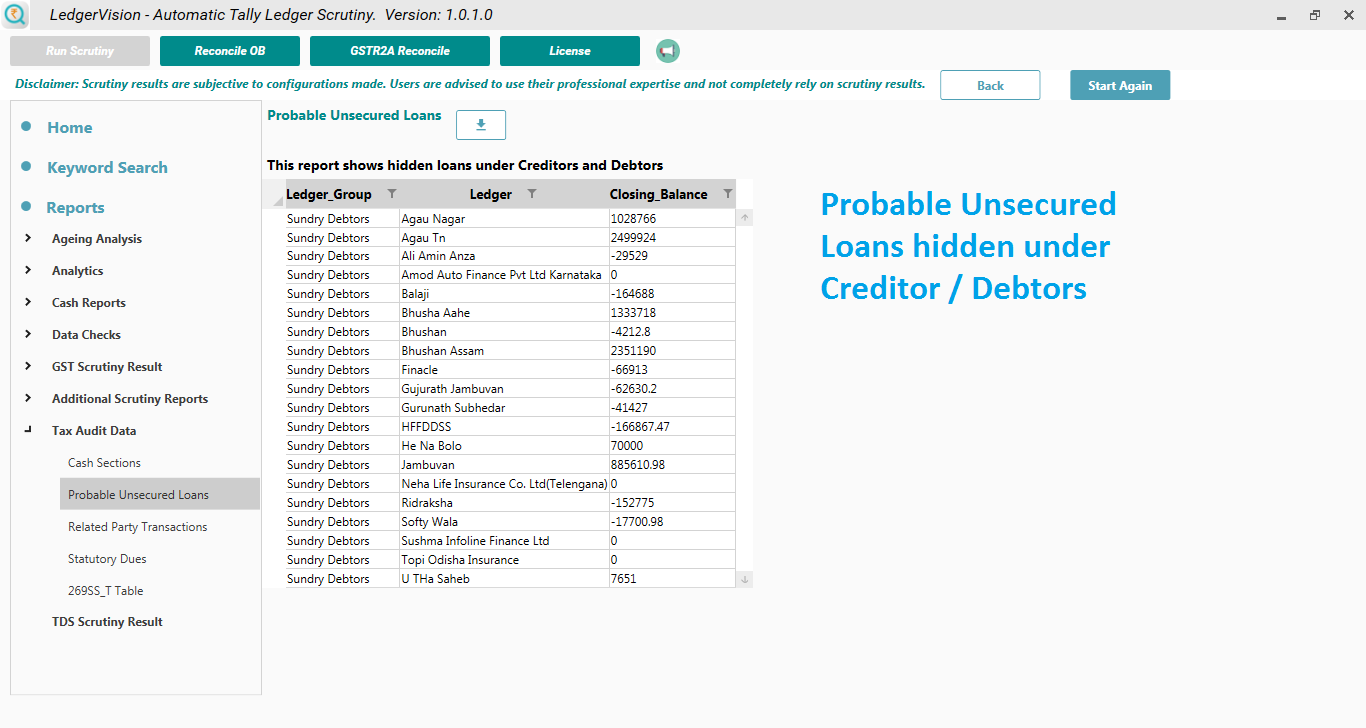

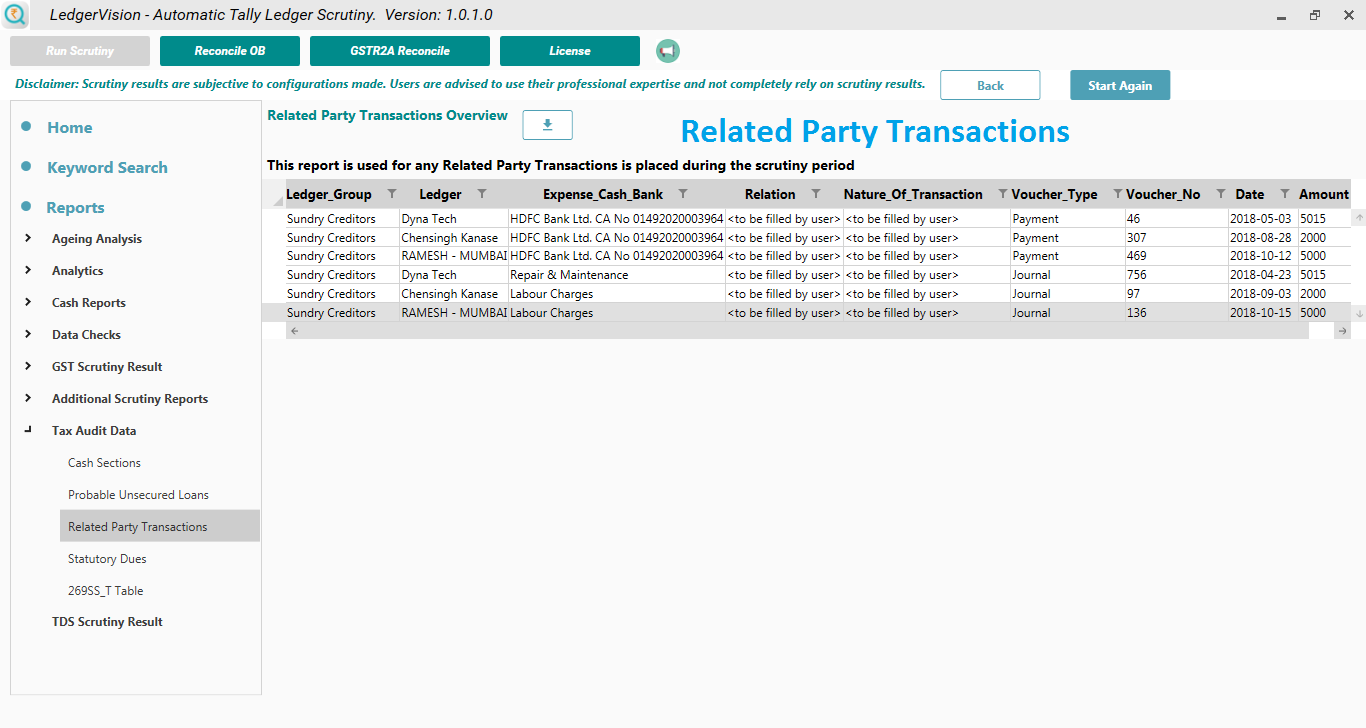

2.Improved Related Party Report

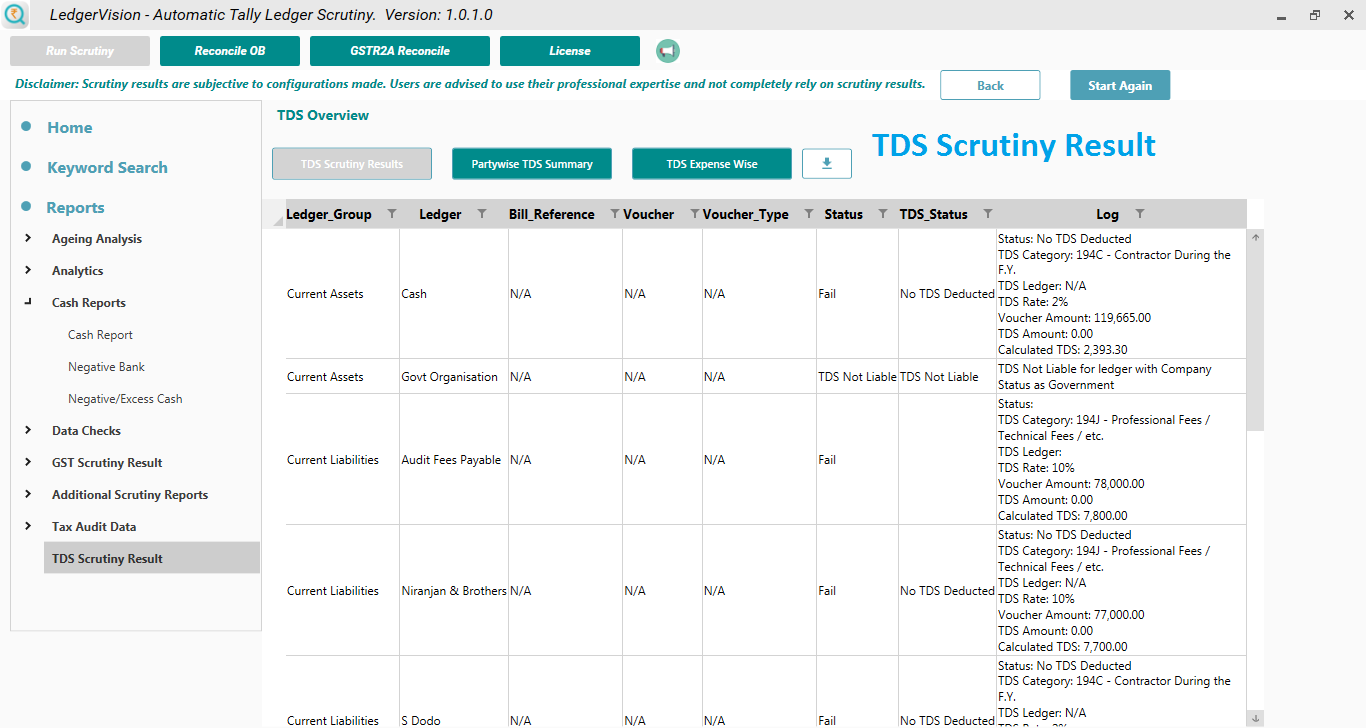

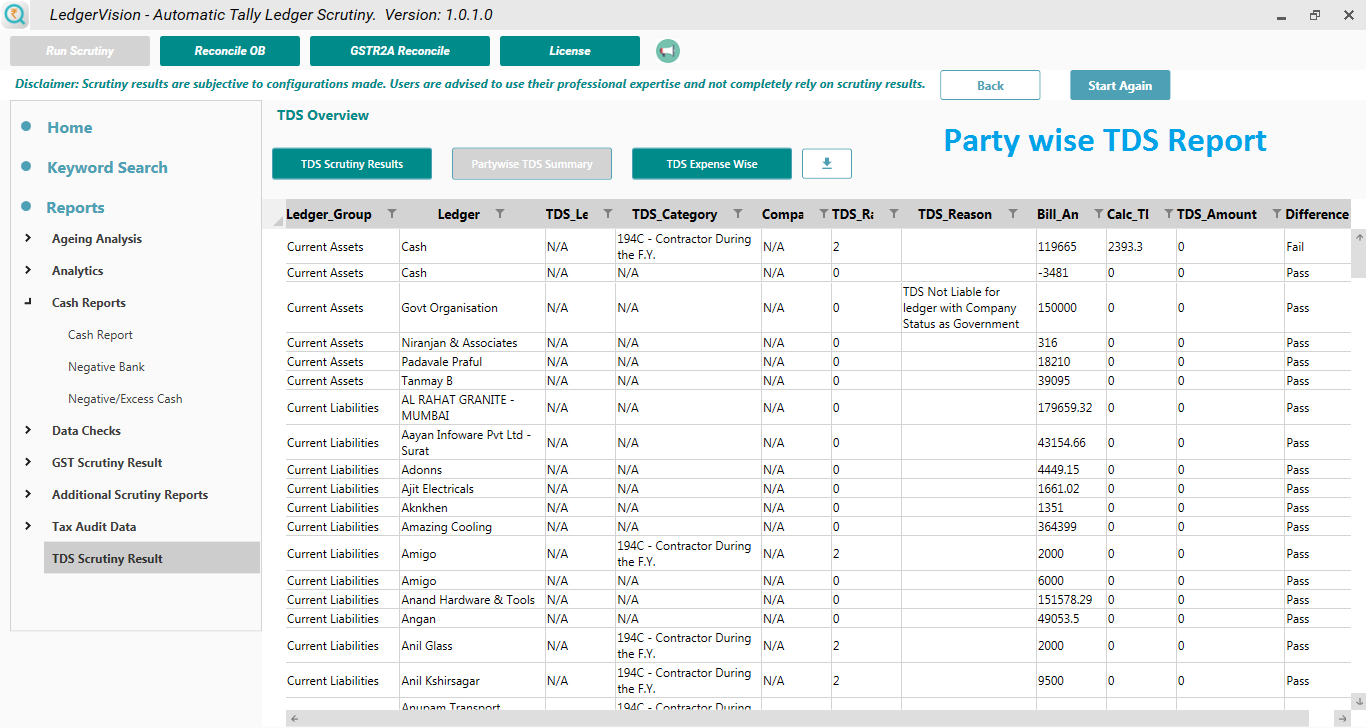

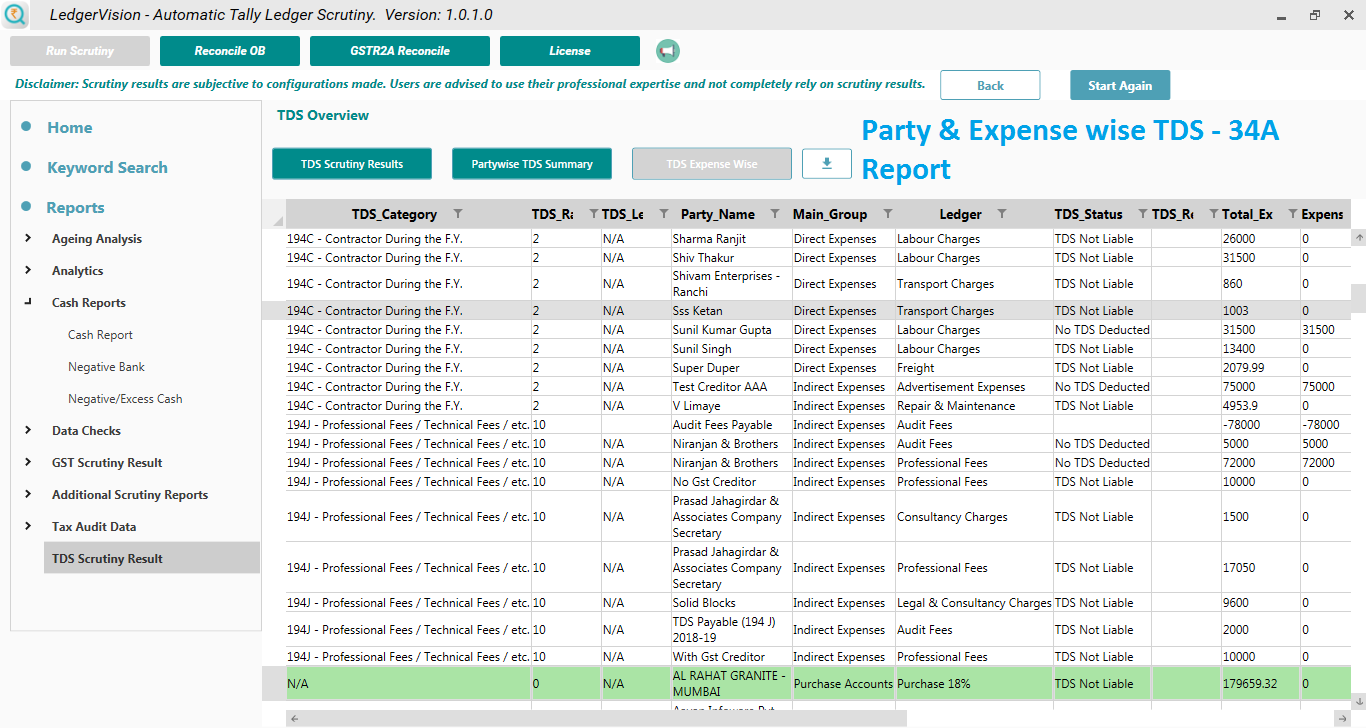

3.Updated TDS rates for FY 2025–26, including 194T and 194LC

4.Added Blocked Credit option in GST ledger config and new report

5.Added RCM column (“Supply attract reverse charge”) in GSTR-2B JSON reports

6.Added dropdowns for all Excel configuration options

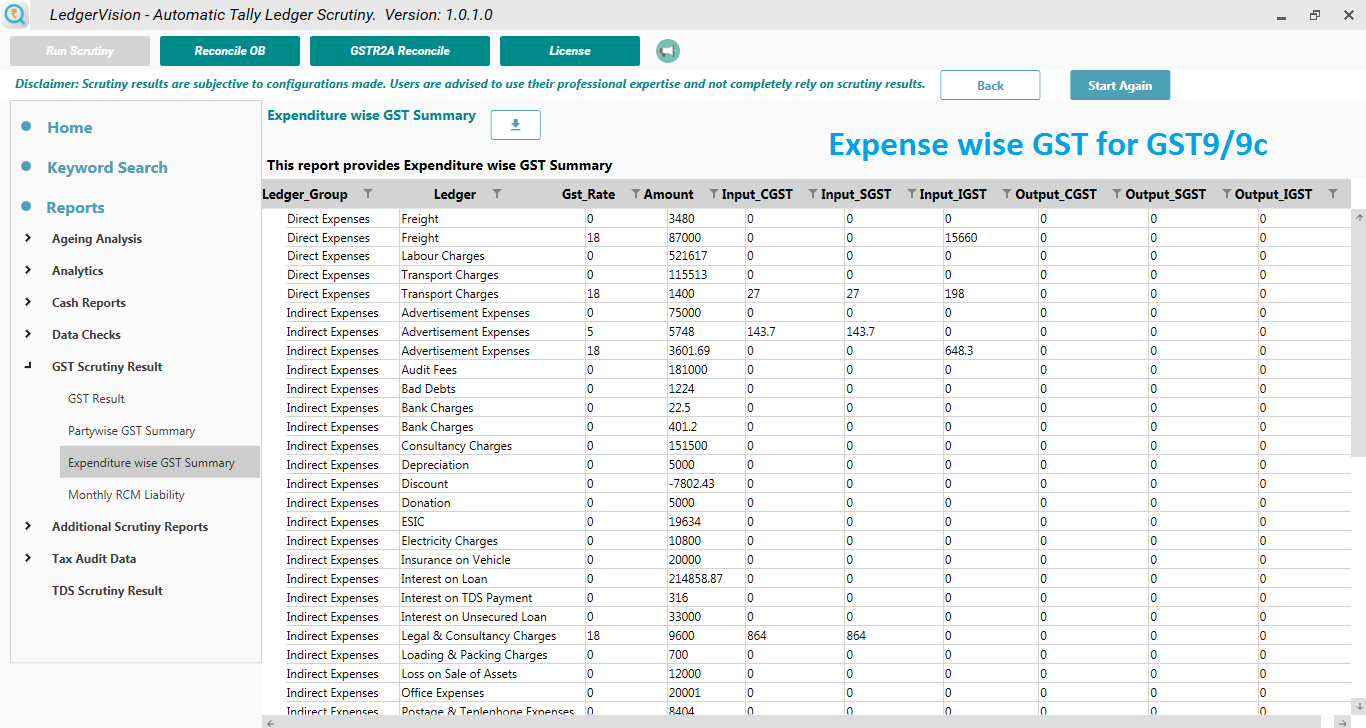

Added GST Type (Services) dropdown and Types of Expenses Summary report

7.Added GST rate-wise Sales Report in GST Results

8.Added GST rates 0.25% & 1.75% for diamonds

Version V43

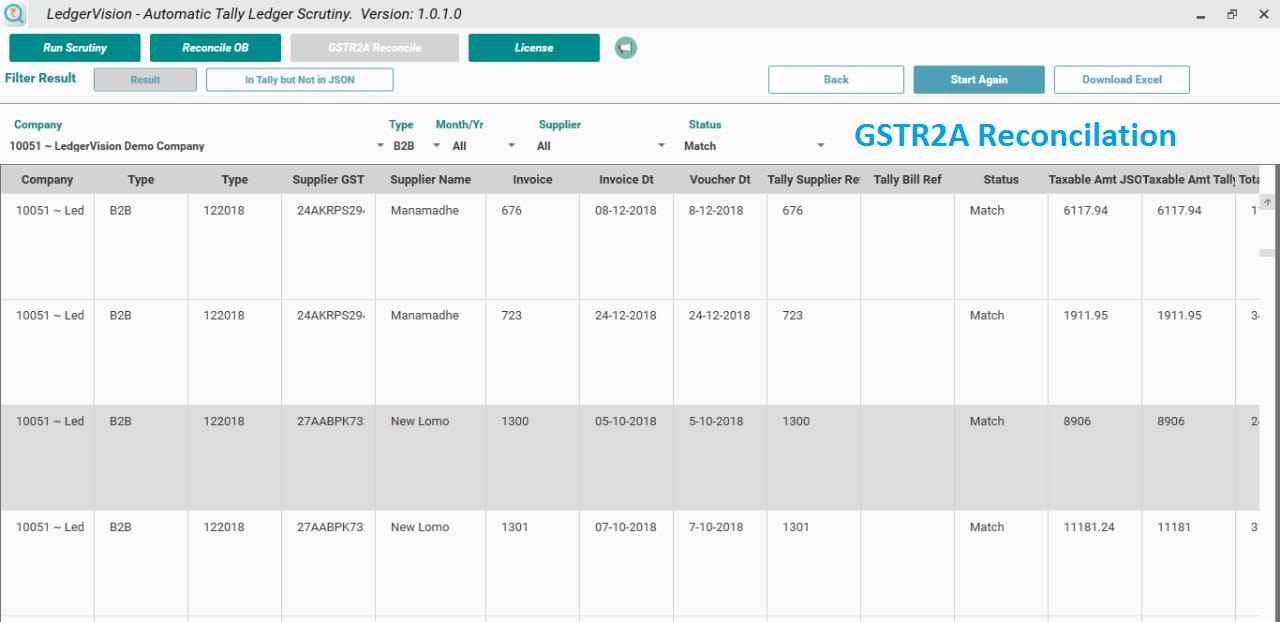

1.Tally Summary is added for GSTR2B, GSTR2A, GSTR1 Reconciliation reports

2.Improved working of Pull tally data on large data

3.Smaller improvements and bug fixex in GSTR2B, GSTR2A, GSTR1

4.Updated GST registration type field

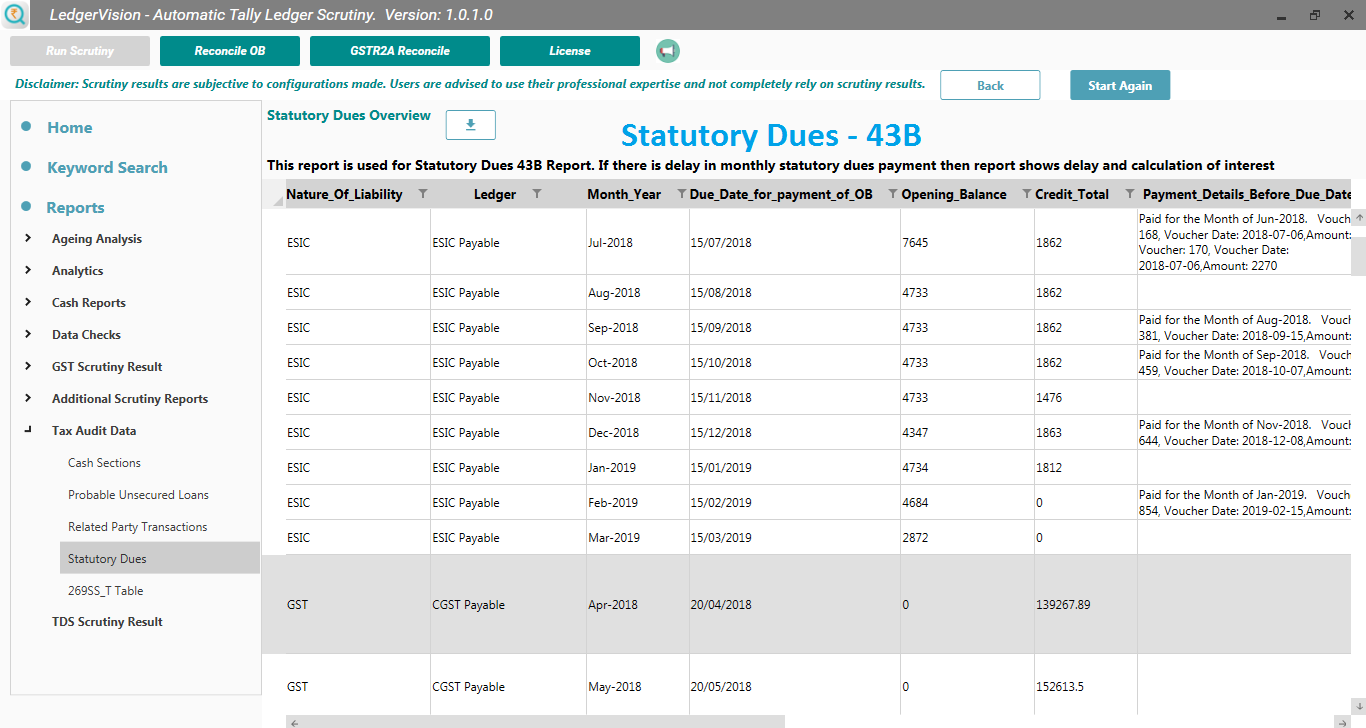

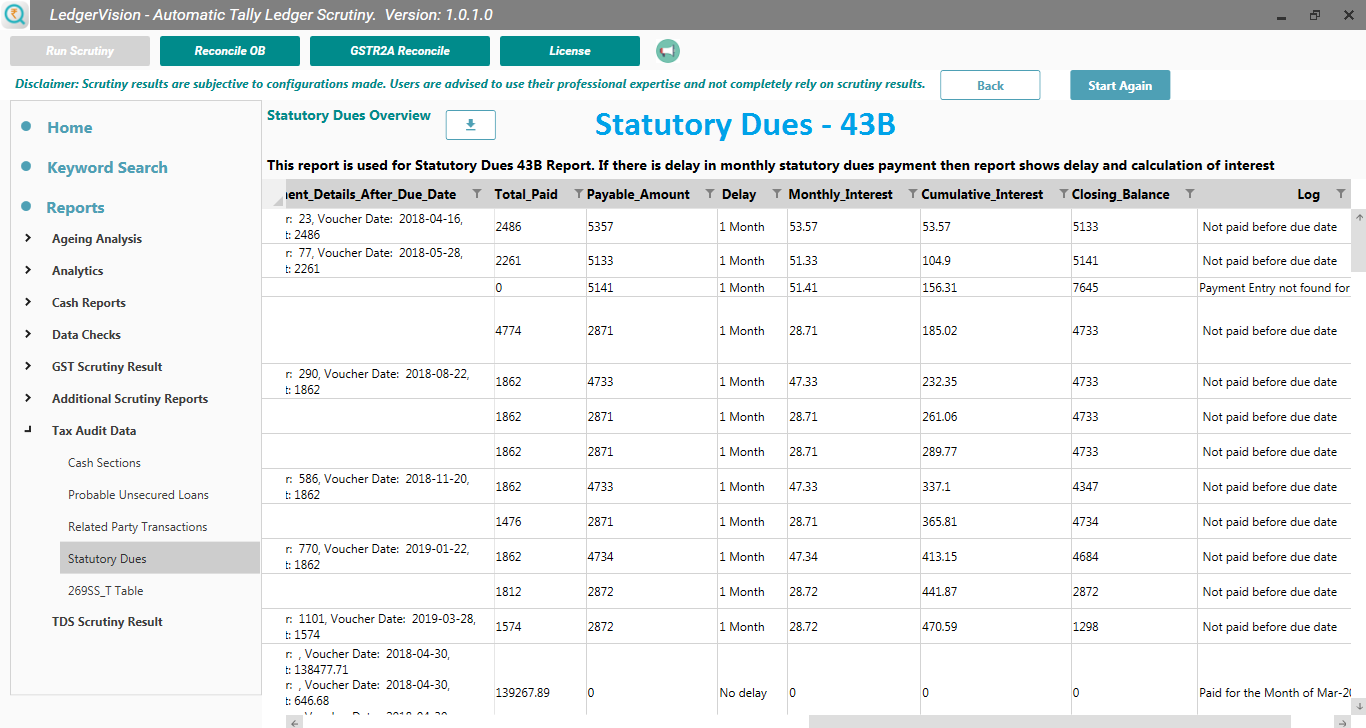

5.Improved working of statutory payments report

6.Bill_credit_period, enterprise_type, udyam_reg_number, msme_activity_type are added in MSME reports

Version V39

1.GSTR 2B report updated as per new formats of JSON files

2.New Functionality added for 26AS Reconciliation

3.Improved working of GSTR2B Reconciliation of single and group company

4.Smaller improvements and bug fixex in GSTR2B, GSTR2A, GSTR1

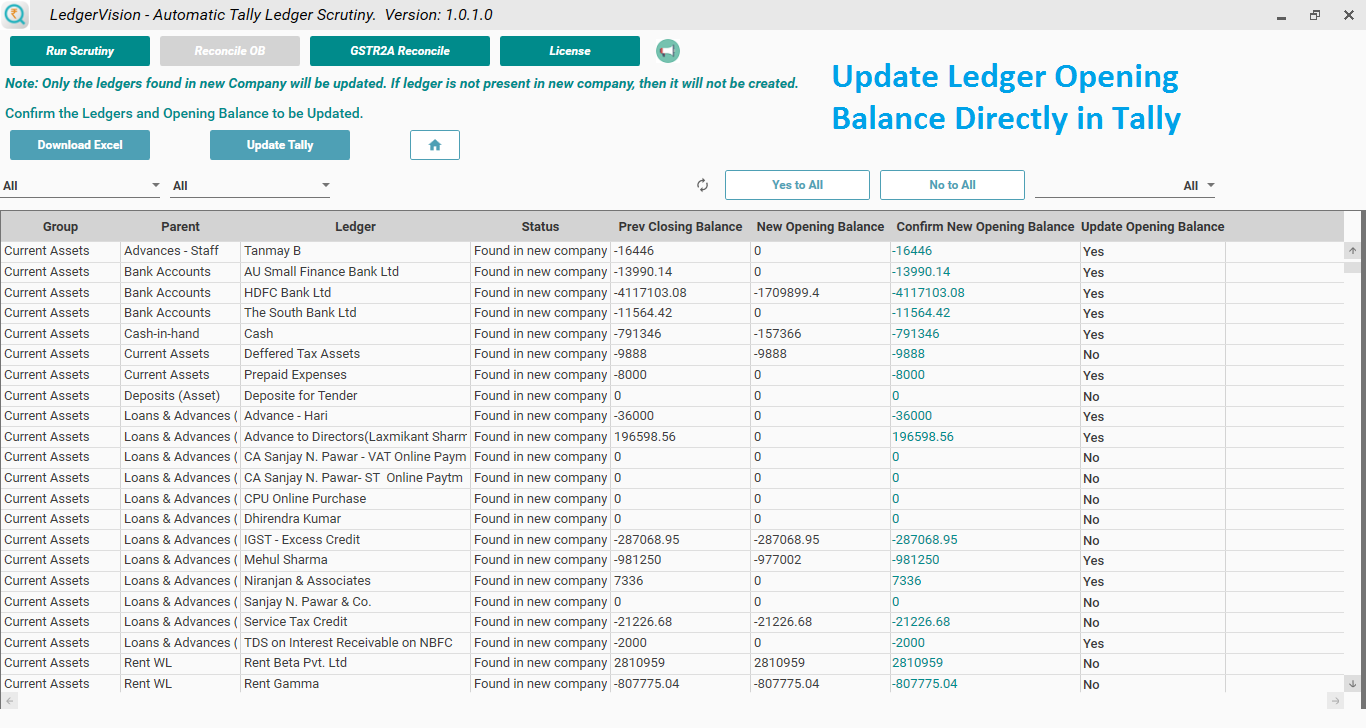

5.Auto ubdate of tally ledger masters is improved

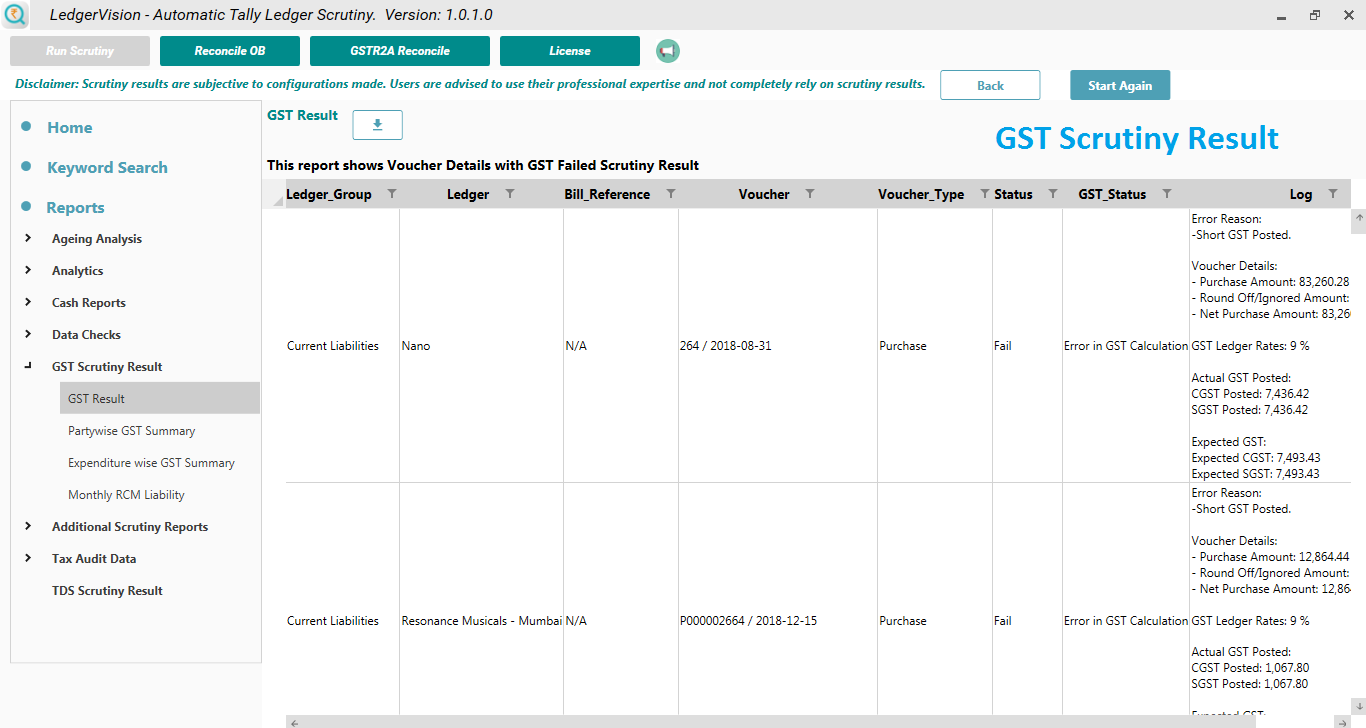

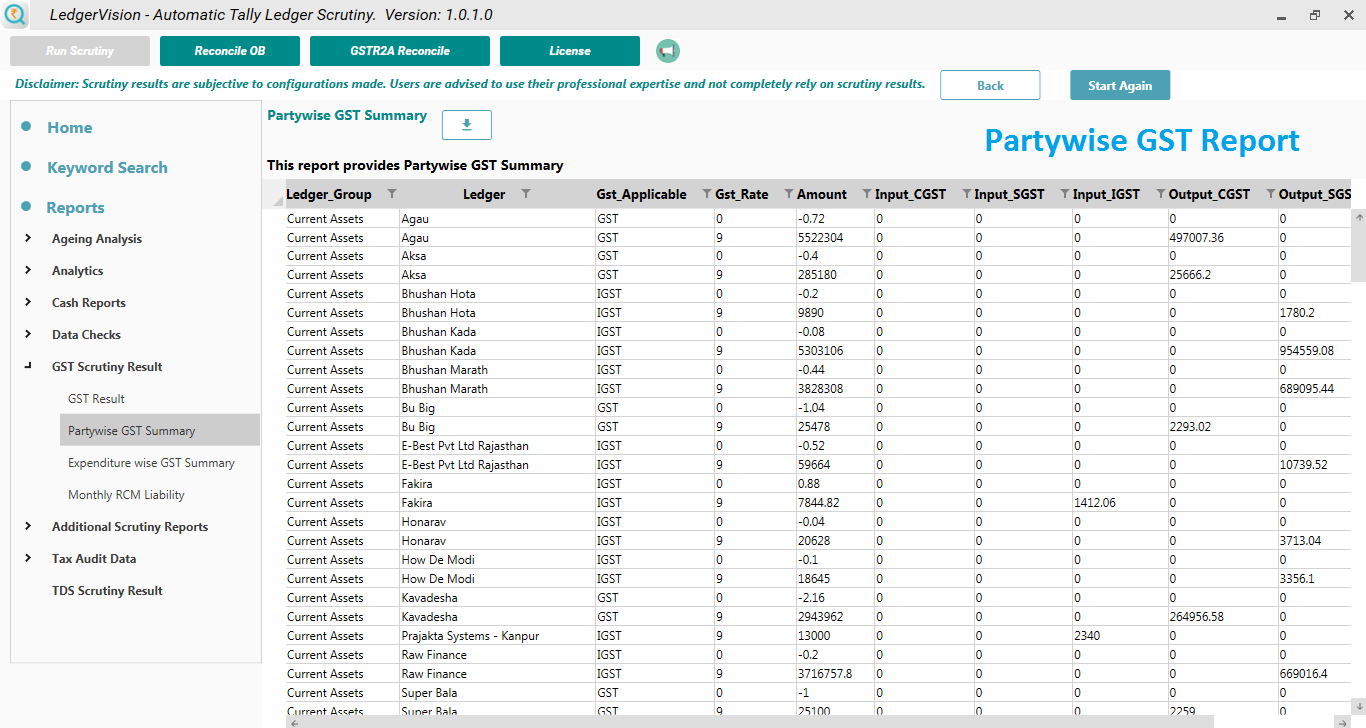

6.GST scrutiny reports updated for data bifurcation

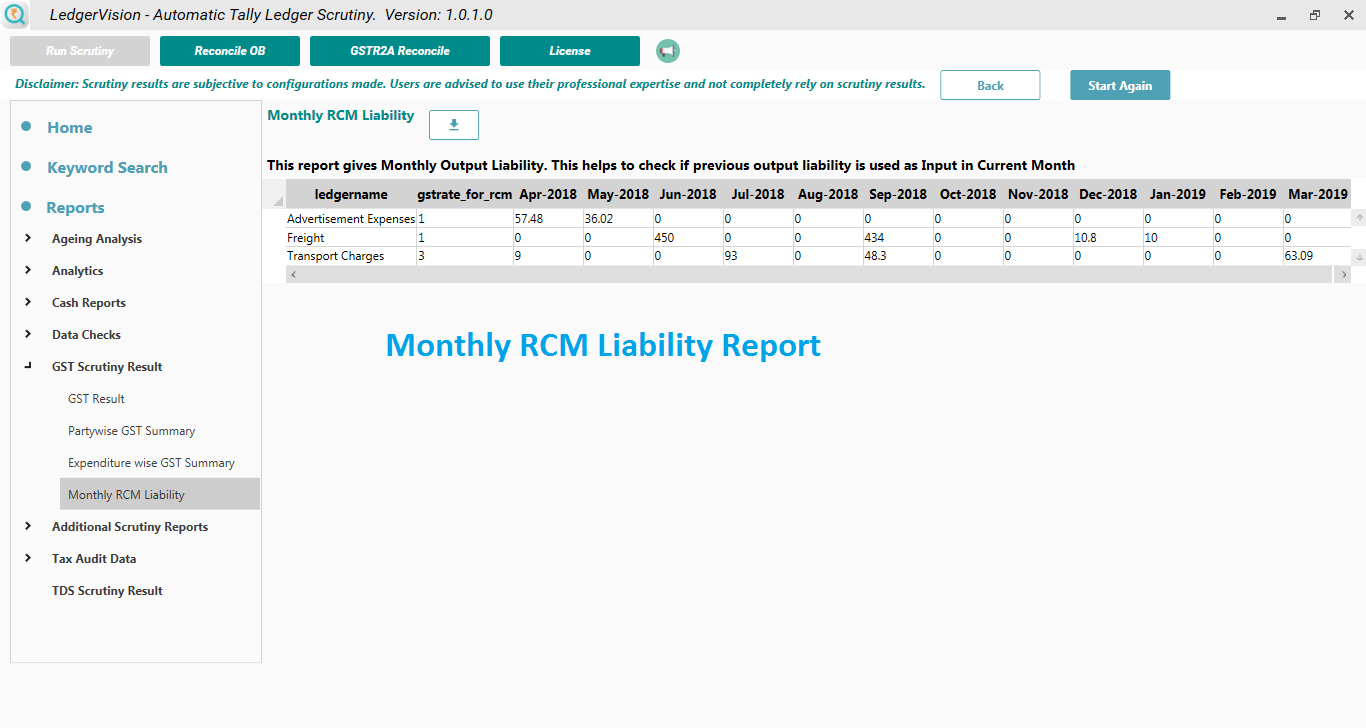

7.Improved working of TDS Expense wise report and disallowance

Version V38

1. Improved GSTR 2A/2B and GSTR1 Accuracy and Bifurcated GST Amount Tally in CGST, SGST, IGST

2. Added Changed GSTR2B JSON format from October 24

3. New Report added in Analytics Reports- Sales through cash

4. New Report added in Analytics Reports- Purchases with cash

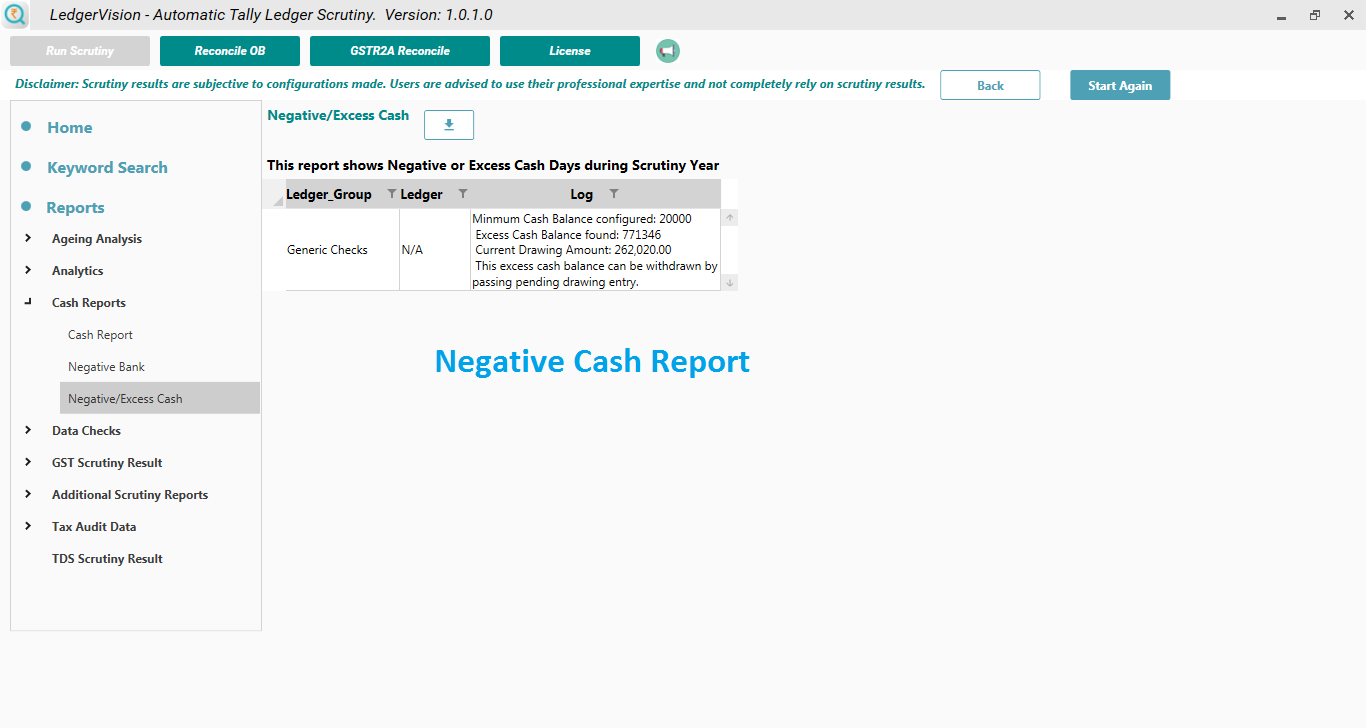

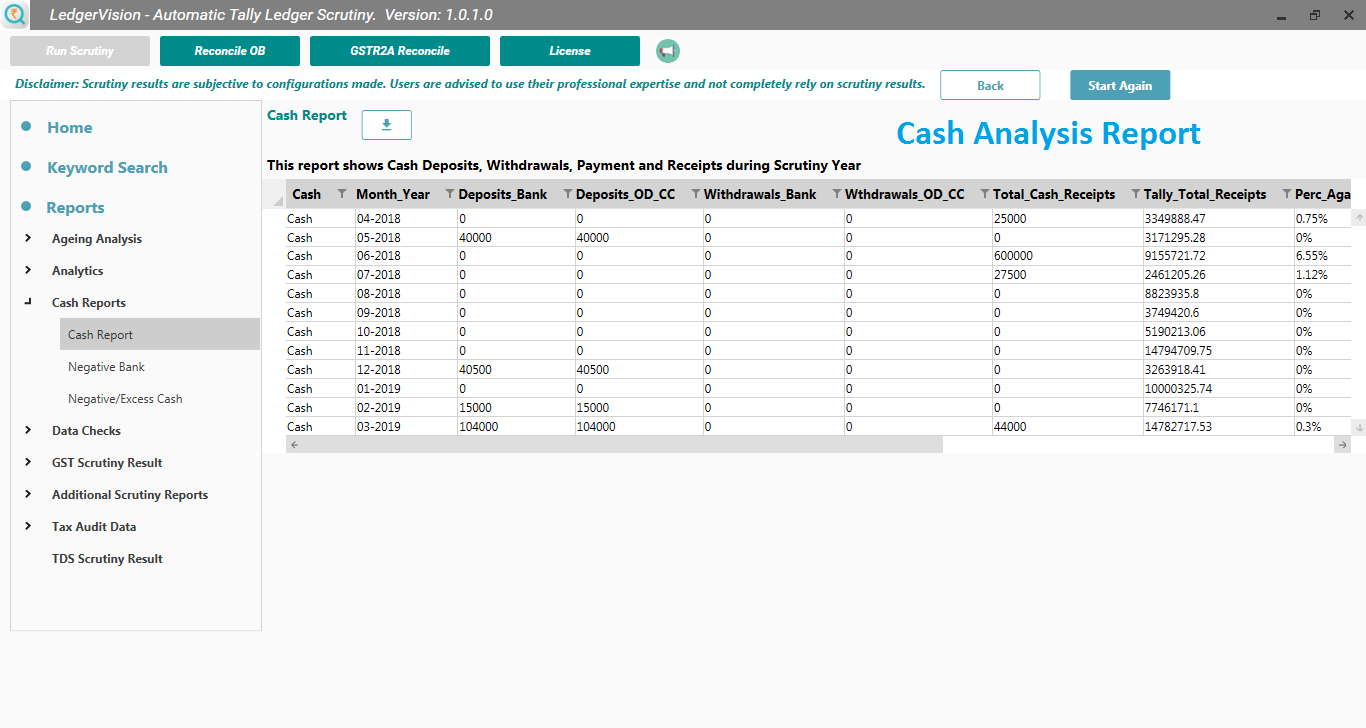

5. Improved cash report and renamed as “Cash Deposits and Withdrawals”

6. New Report “Section 44AB” is added in Tax audit result

7. TDS rate 194H is changed from 5% to 2% from 1-october-2024 on-words

8. Improved working of 43BH report

9. New report is added Related Party Summary

Version V37

New Report added for Identifying Total Cash Receipts from Debtors

New Report Added for Identifying Total Cash Payments to Creditors

Added TCS u/s 206 C 1F – TCS on Sale of Motor Vehicle

Improved GSTR 2A/2B and GSTR1 Accuracy and Speed of Reconciliation